…Income diversification approach

KEY FINDINGS:

- A private tertiary institution with a 17.60% income diversification venture will sustain financially during the COVID-19 pandemic era.

COVID-19 is presently raising the threat to the financial sustainability of private tertiary institutions (PTIs). They are limited to the accomplishment of their missions and their ability to provide top-of-the-line educational programs and resources to learners in different disciplines. Problems of financial sustainability of educational institutions typically have a repercussion that continues to grow dramatically, given the decrease of government funding and the decline in enrollment (Marginson 2017; Wu 2017).

Based on the financial sustainability problems, over 104 private tertiary institutes closed in the USA between 2004 and 2012 on average (Greenwell, 2017).

In Africa, there are various financial difficulties for PTIs. Ahmed (2015 ) states in Nigeria that PTIs lack the resources they are supposed to seek in their attempts to achieve their objectives. Mugo and Ngahu (2015) observe that many PTIs in Kenya have completely folded because they cannot help themselves financially. A lot of PTIs in Ghana are on life support (Addo, 2018). Even before COVID-19, some PTIs had already laid off some of their workers to stay afloat in Ghana. Currently, PTIs are considering all forms of cost reduction control measures. It is the opinion of the authors of this article to test the income diversification approach of PTIs to stay afloat during the COVID-19 era, and after based on the institutional ownership type, that is denominational versus non-denominational profile.

The traditional source of revenue (tuition fees) of PTIs is decreasing due to severe competitions from public educational institutions. Almost all the heads of private educational institutions are expressing worries on the current trend of enrolment competition because they require significant effort to admit, at most, 1,000 students in a given academic year (Nsowah-Nuamah, 2017; Donkor, 2017; Siaw, 2018; Bediako, 2019).

More recently, the emergence of the COVID-19 has also highlighted the issue of excess dependence on the conventional revenue source by PTIs. Education is one of the most affected industries in the Ghanaian economy. To avoid the spread of the virus, the government ordered the suspension of numerous operations, including schooling (Dogbey, 2020). The pandemic exacerbated the financial burden of the PTIs, which needed to pay its employees despite the pause in tuition payments. The institutions need help from the government, as most of them cannot pay their employees’ salaries (Quartey, 2020; Dogbey, 2020).

Many educational experts expect that PTIs will be closing before 2028 (Alhassan, 2017; Eide, 2018). These forecasts call for joint efforts to tackle the PTIs’ financial sustainability challenges because these institutions make significant impacts on the socio-economic growth of the global economy by the access to higher quality training (Yanka, 2017).

Ekpoh and Okpa (2017) looked at diversifying sources of sustainability funding for university education, its challenges, and development strategies. The study sampled 480 respondents from four federal universities across Nigeria’s south-south region. Findings indicated that diversifying university income to include consulting services, marketing of physical facilities, part-time degree programs, proper financial management, and eliminating poor employee attitude increased enrolment with its resulting positive impact on the financial sustainability of universities in Nigeria’s South-South region.

Amos and Koda (2018) analyzed the contribution that the Catholic Diocese of Moshi in Tanzania is making from school-based income-generating activities in providing quality education in secondary schools. The research was interviewed 252 respondents from 12 Catholic Church-operated secondary schools. The study concluded that institutional projects are important alternative ways of generating additional income as they enable financial problems to be solved by second-cycle institutions. The study identified grain, vegetable, and poultry cultivation as the schools’ significant ventures.

Nyamwega (2016) assessed income-generating projects at Nairobi County’s public secondary schools. The researcher analyzed public institutions. The study revealed that the schools received annually from ventures between KShs 680,000and KShs 6,000,000 ($6,559 and $57,876 respectively, an indication that school-based ventures are profitable. The study concluded that to remain financially viable; institutional managers should be more creative in launching more institutional projects.

Adan and Keiyoro (2018) did a study in Kenya on factors affecting the implementation of income-generating projects at public secondary schools in Isiolo. The study found that institutional initiatives improve financial sustainability as it enables educational institutions to cope with the financial dynamics without necessarily shifting budget overruns to parents and guardians. Therefore, the researchers called on management to equip those in charge of ensuring the viability of income-generating activities in secondary schools in Isiolo North Sub- County, Kenya.

Sakawa and Watanabel (2020) found that the strategic and monitoring positions of the institutional owners improve institutional resilience for higher growth opportunities. The researchers looked at shareholder ownership and firm performance under stakeholder-oriented corporate governance in Japan using 2924 company-year observation of large listed Japanese companies.

Institutional profile, used in this analysis as a moderator, defines institutional ownership, classified under both denominational and non-denominational. Institutional variations are increasing in this sample, and each institution’s expertise becomes crucial as the schools can vary in ownership. Studies also found institutional profile affecting institutional financial sustainability (Kisengo & Kombo, 2014; Hossain & Khan, 2016; Lambinicio, 2016; Ibrahim, 2019).

Methodology

The researchers sought to address the research questions of finding the correlation between income diversification and financial sustainability among PTIs and going to investigate further the moderation of institutional type on their economic sustainability approach related to income diversification. This study adopted a causal research design to study the correlation between income diversification and financial sustainability among PTIs. Among the institutions used in the Greater Accra Region, 14 (35%) were denominational, and 26 (65%) were non-denominational. The study utilized parametric inferential statistics by relying on regression Process v3.2 by Andrew F. Hayes model 1. The study was carried out in PTIs in the Greater Accra Region of Ghana. Forty out of the sixty PTIs in the region were randomly sampled to answer the self-constructed questionnaires with the Cronbach Alpha of .863 for income diversification and .852 for financial sustainability.

Results and dicusssion

The research explored the relationship between the diversification of income and financial sustainability. The analysis showed a moderately positive significant association between income diversification and financial sustainability (R=0.4195, p=0.024). This indicates that a rise in the diversification of income allows the PTIs to be financially sustained. The study showed that the determination coefficient was 17.6% (R2=0.1760), which means that the diversification of income would predict financial sustainability by 17.60%. The consequence of this outcome is that achieving the financial sustainability of PTIs is moderately dependent on diversification of income. This result confirms Amos and Koda (2018) research in Tanzania among second cycle institutions, Ekpoh and Okpa (2017 ) study in Nigeria’s South-South Region, and Nyamwega (2016) study in Kenya among public secondary schools that diversification of income contributes reasonably to the financial sustainability of PTIs.

Table 1. Model Summary

| R | R2 | MSE | F | df1 | df2 | P | IV | |

| Model Summary | 0.4195 | 0.1760 | 0.1171 | 2.5623 | 3.0000 | 36.0000 | 0.0240 | S |

|

Interaction Model |

0.0566 |

2.4742 |

1.0000 |

36.0000 |

0.0450 |

S |

S=Significant, NS= Not Significant

The final investigation for this research was to find out the moderating impact of institutional profile on the relationship between PTI ‘s income diversification and financial sustainability. By following the model of Jose (2013), Haye (2009), and Hayes and Matthes (2009) the study of the impact of moderation is described and submitted. The power of moderation, that is, an effect of interaction, is seen either as enhancing or as antagonistic (Hayes & Matthes, 2009). An improved effect of moderation is when an increase in moderator quantity (institutional profile) causes an increase in the influence of the independent variable on the dependent variable. An antagonistic effect is when a moderator increase has an opposite effect on the independent variable.

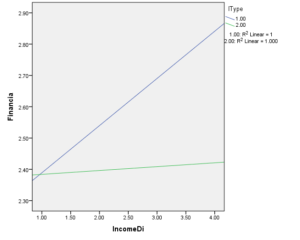

In the model, 1 represented the denominational institutions, and 2 represented the non-denominational institutions. The initial overview model showed a considerable variance value of R2 = 0.1760, F=2.562, p=.0240 financial sustainability. It then implemented the relationship between financial sustainability and institutional profile. With an interaction model, the moderating variable induced a significant change in the process ΔR2 = 0.0566, ΔF= 2.4742, p= 0.0450 as shown in Table 1. When analyzing the interaction plot of the institutional profile, Figure 2 illustrates the effect of moderation on financial sustainability and the consequences of income diversification. It is noted that it is also enhanced, and statistically important, an enhancing impact of income diversification on financial sustainability because of the positive relationship with the implementation of the interaction of institutional forms.

Diversification and financial sustainability of PTIs

A detailed analysis, as shown in figure 2 on substantial moderation, also showed that most denominational PTIs ( blue line 1) rely on income diversification in achieving financial sustainability compared with non-denominational PTIs (Green line 2). The outcome of this research is a Sakawa (2020) report confirmation that institutional ownership has an enhanced impact on financial sustainability. Although denominational institutions rely on diversification of income in order to maintain financial sustainability, non-denominational institutions rely less on this. This suggests that income diversification strategies would differ between denominational and non-denominational tertiary institutions for the financial survival of PTIs.

Conclusion and Recommendations

The relationship between income diversification and financial sustainability has been moderately positive. This means an increase in PTIs’ financial sustainability as the management puts considerable effort into strategies for diversifying income. Diversification of income could predict financial sustainability by 17.60%. A private tertiary institution with a 17.60% income diversification venture will sustain financially during the COVID-19 pandemic era. This study also has shown that denominational PTIs are currently relaying on income diversification ventures stay afloat during this COVID- 19 era more than non-denominational PTIs. Furthermore, PTIs institutional profiles are enhancing the impact of income diversification on financial sustainability. The study concludes that PTIs’ financial sustainability is based on strategies to diversify incomes during the COVID-19 era. Therefore the research suggests that the PTIs invest in profitable projects to diversify revenue.

REFERENCE LIST

Adan, S.M., & Keiyoro, P. (2017). Factors influencing the implementation of income generating projects in public secondary schools in Isiolo North Sub County, Kenya. International Academic Journal of Information Sciences and Project Management, 2(1), 558-573.

Addo, C. (2018, March 12). Central running on life support-Registrar. Retrieved from https://www.yen.com.gh/ 107277-central-university-running-life-support-registrar.html#107277

Ahmed, S. (2015). Public and private higher education financing in Nigeria. European Scientific Journal, 11(7), 92-109.

Alhassah, I. (2018, March 29). Revise programmes to avoid collapse – NAB to Private Unis. Retrieved from https://starrfmonline.com/2018/03/revise-programmes-avoid-collapse-nab-private-unis/

Amos, O., & Koda, G.M. (2018). Contribution of school-based income generating activities in quality education provision in secondary schools managed by the Catholic Diocese of Moshi, Tanzania. British Journal of Education, 6(4), 49-69.

Bediako, K.D. (2019). 25th Congregation and 40th Anniverasry Celebration (Vice-Chancellor’s Report). Valley View University

Dogbey, S.A. (2020, April 28). Ghana National Association of Private Schools pursue financial aid to pay salaries of teachers. Retrieved from https://www.myjoyonline.com

Donkor, E.A. (2017, December 14). Private universities facing financial challenges despite rebate – University President. Retrieved from https://www.myjoyonline.com/news/ 2017/ December-

Eide, S. (2018, Fall). Private colleges in peril. Retrieved from https://www.educationnext.org/ private-colleges-peril-financial-pressures-declining-enrollment-closures/

Ekpoh, U.I., & Okpa, O.E. ( 2017). Diversification of sources of funding university education for sustainability: Challenges and strategies for improvement. Journal of Education, Society and Behavioural Science, 21(2), 1-8. doi: 10.9734/JESBS/ 2017/ 34494

Greenwill, B. (2017). Business strategies to increase the financial stability of private universities. Retrieved fromhttp://www.scholarworks. waldenu.edu/dissertations

Hayes, A.F. (2009). Beyond Baron and Kelly: Statistical mediation analysis in the new millennium. Communication Monograph, 76, 408-420. Doi: 10.1080/03637750903310361.

Hayes, A.F., &Matthes, J. (2009). Computational procedures for probing interactions in OLS and logistic regression: SPSS and SAS implementations. Behavior Research Methods, 41, 924-936.

Hossan, M.S., & Khan, M.A. (2016). Financial sustainability of microfinance institutions (MFIs) of Bangladesh. Developing Country Studies, 6(6), 69-78. Retrieved from https://www.pdfs. semanticscholar.org/e967/ 4a43bd2b51be263bbeb85e9281e46ad890ac.pdf

Ibrahim Y., Ahmed, I., & Minai, M.S. (2018).The influence of institutional characteristics on financial performance of microfinance institutions in the OIC countries.Economics and Sociology, 11(2), 19-35. doi:10.14254/2071-789X.2018/112/2.

Kisengo, Z.M., & Kombo, H. (2014). Effect of firm characteristics on performance of the microfinance sector in Nakuru, Kenya.International Journal of Science and Research, 3(10), 1791-1799. Retrieved from https://www.ijsr.net

Lambinicio, J.S. (2016). Organizational Performance of Higher Education Institutions in Pangasinan. Paper presented at the Third Asia Pacific Conference on Applied Research, Melbourne. Retrieved from https://www.apiar.org.au/journal-paper-/organizational-performance-of-higher-education-institutions-in-pangasinan/

Marginson, S. (2017). Global Trends in Higher Education Financing: The United Kingdom. International Journal of Educational Development. Retrieved from https://www. sciencedirect.com/science/ article/pii/S0738059 317301748

Mugo, A.N., & Ngahu, S.T. (2015). Assessment of financial challenges affecting operations of private tertiary colleges in Nakuru town, Kenya. International Journal of Economics, Commerce and Management, 3(5), 1476-1486.

Nsowah-Nuamah (2017, November 12). Private universities face imminent collapse-Prof. Nsowah-Nuamah. Retrieved from https://www.myjoyonline. com/news/2017/ November-12th/private-universities-face-imminent-collapse-prof-nsowah-nuamah.php

Nyamwega, H.N. (2016). An evaluation of income generating projects in public secondary schools in Nairobi County. International Journal of African and Asian Studies, 21, 6-16.

Quartey, P. (2020). COVID-19 and the plight of private school teachers in Ghana. Statistical, Social and Economic Research.

Sakawa, H., & Watanabel, N. (2020). Institutional ownership and firm performance under stakeholder-oriented corporate governance. Sustainability Journal, 12(3), pp 1-21.Retrieved from https://www.doi.org/10.3390/su12031021

Siaw, E.K. (2018, November 17). Public universities crippling private universities. Retrieved from https://www.modernghana.com/news/897917/public-universities-crippling-private-universities.html

Wu, F.H. (2017). The crisis of American higher education. Retrieved from https://www.tah. oah.org/february-2017/the-crisis-of-american-higher-education/

Yanka, K. (2017). Leadership for a changing public-private higher education landscape. A paper presentation at 2017 International Association of Universities Conference, Accra, Ghana. Retrieved from https://www.ug.edu.gh/sites/default/files/images/Address%20 by%20 Professor%20Kwesi%20 Yankah %20%20-%20IAU%202017%20 INTERNATIONAL%20 CONFERENCE.pdf

Authors:

Dr. Williams Kwasi Peprah,

Ph.D. in Commerce majoring in Accounting and Finance

General Manager at Valley View University Ventures and a Lecturer at the School of Business. Email: [email protected]

Francis Osei-Kuffour, FCCA

Internal Auditor and a Lecturer at the School of Business

Valley View University, Accra. Email: [email protected]