The COVID-19 pandemic could be a game changer for digital financial services. Low-income households and small firms can benefit greatly from advances in mobile money, fintech services, and online banking. Financial inclusion as a result of digital financial services can also boost economic growth. While the pandemic is set to increase use of these services, it has also posed challenges for the growth of the industry’s smaller players and highlighted unequal access to digital infrastructure. Several actions will need to be taken to ensure maximum inclusion going forward.

Low-income households and small firms can benefit greatly from advances in mobile money, fintech services and online banking.

The shift towards digital financial services was already helping societies advance financial inclusion before the pandemic started, benefiting many low-income households and small firms with typically little access to traditional financial institutions. Lockdowns and social distancing are accelerating the use of digital financial services, just as the SARS epidemic in 2003 hastened China’s launching of digital payments and e-commerce.

Many countries (for example, Liberia, Ghana, Kenya, Kuwait, Myanmar, Paraguay and Portugal) are supporting this shift with measures such as lowering fees and increasing limits on mobile money transactions.

Africa and Asia lead the way

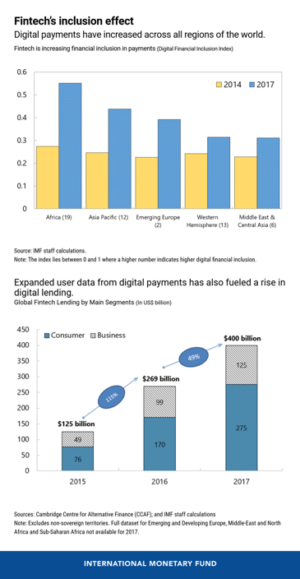

In a new study, we introduce an index of digital financial inclusion that measures the progress in 52 emerging market and developing economies. We found that digitalization increased financial inclusion between 2014 and 2017, even where financial inclusion through traditional banking services was declining. This is likely to have progressed more since then.

Africa and Asia lead digital financial inclusion, but with significant variation across countries. In Africa, Ghana, Kenya, and Uganda are front runners. In comparison, the Middle East and Latin America tend to use digital financial services more moderately. In some countries, such as Chile and Panama, this likely reflects a relatively higher level of bank penetration.

In most countries digital payments services are evolving into digital lending, as companies accumulate users’ data and develop new ways to use it for credit worthiness analysis. Marketplace lending, which uses digital platforms to directly connect lenders to borrowers doubled in value from 2015 to 2017. While so far concentrated in China, the United Kingdom, and the United States, it appears to be growing in other parts of the world, such as in Kenya and India.

Benefits beyond financial inclusion

Financial inclusion benefits economies and societies as a whole. Previous studies have found that extending traditional financial services to low-income households and small firms goes hand-in-hand with increasing economic growth and reducing income inequality. Our analysis finds that digital financial inclusion is also associated with higher GDP growth.

During the COVID-19 lockdowns, digital financial services are enabling governments to provide quick and secure financial support to “hard-to-reach” people and businesses, as demonstrated in Namibia, Peru, Zambia, and Uganda. This will help mitigate the economic fallout and potentially strengthen the recovery.

The task ahead

To tap the high potential of digital financial services in the post-COVID era, many factors need to fall into place. Equal access to digital infrastructure (access to electricity, mobile and internet coverage, and digital ID); greater financial and digital literacy; and the avoidance of data biases are necessary for a more inclusive recovery.

A global survey we conducted with more than 70 stakeholders—fintech firms, central banks, regulatory bodies, and banks—revealed that regulators need to keep up with fast-paced technological changes in fintech to ensure consumer and data protection, cybersecurity, and interoperability across users and national borders. Fintech firms also indicated a global shortage of “coders”—software developers and programmers.

At the same time, it is important to ensure that the fintech landscape remains sufficiently competitive to maximize the gains from digital financial services. The COVID-19 crisis has presented potential benefits for the sector but also poses challenges for smaller fintech companies: tightening of funding, rising non-performing loans, decline in transactions and credit demand. Some halted new lending since the onset of lockdowns. Widespread consolidation and retrenchment of start-ups would lead to greater concentration in the sector and could set back inclusion. In the public’s interest, this points to accelerating the creation of governance frameworks for big fintech companies.

The pandemic shows that the trend towards greater digitalization of financial services is here to stay. To build inclusive societies and address rising inequalities during and after the ongoing crisis, global and national leaders must close the digital divide across and within countries to reap the benefits of digital financial services. This means finding the right balance between enabling financial innovation and addressing several risks: insufficient consumer protection, lack of financial and digital literacy, unequal access to digital infrastructure, and data biases that need action at the national level; as well as addressing money laundering and cyber risks through international agreements and information sharing, including on antitrust laws to ensure adequate competition