Government attributed and commended the strong performance of Ghana Reinsurance Company to the Board, Management and Staff of the company at its 17th Annual General Meeting (AGM) in Accra last week.

Ghana Re announced a group composite (life and general business) gross premium income for 2019 of GH¢253.37m compared to the GH¢205.66m recorded in 2018, representing a growth rate of 23.2%.

However, a breakdown of the group shows that general business premium income recorded in 2019 was GH¢230.85m, while life premium income stood at GH¢22.52m.

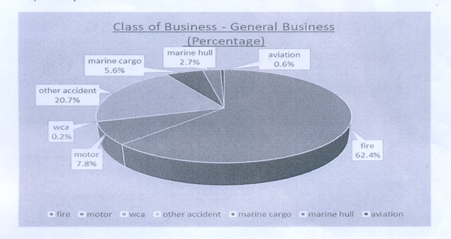

George Otoo, Chairman of the Board, noted that fire insurance as a line of business contributed 62.42% of the general business premium income, while accident and motor insurance contributed 20.7% and 7.8% respectively to the portfolio.

“We would not have been able to record this financial achievement in premium income without the support of our loyal cedants; for that, I thank all our cedants for contributing to our continued success,” the chairman said at the 17th Annual General Meeting.

Announcing further, he said management expenses recorded for the same period was GH¢41.43m as against GH¢43.20m in 2018, representing a decrease in management expenses ratio from 21.9% in the year 2018 to 19.7% in the year under review.

Profit before tax for the period was GH¢40.80m, representing a 23.1% decrease on the figure of Gh¢53.03m for 2018; while profit after tax was GH¢30.16m as against GH¢38.63m in 2018. The slump in profit was attributed to higher than expected claims in 2019.

George Otoo indicated that based on the company’s performance, a dividend of GH¢0.18 per share was paid to sole shareholders – stressing that the board is committed to the group’s sturdy growth and will continue to exercise its oversight mandate to ensure profitability of the company.

On the COVID-19 pandemic, the chairman stated that Ghana Re – as part of measures to ensure business continuity and profitability – has activated its business continuity plan and accelerated the company’s information technology infrastructure upgrade.

He further added that with a good retrocession arrangement and prudent management practices, the company is well-positioned to meet its claims and other financial obligations.

The chairman assured shareholders that: “Ghana Re will employ and continually improve on its technical expertise and information technology system to enhance the turnaround time for service delivery. In addition, the company will seek to capitalise on its strong financial base and unblemished reputation to increase acceptances of non-traditional insurance products, forge strategic partnerships and position the company in the face of growing competition”.