Economic activity this year will be significantly lower than projected in the April 2020 Regional Economic Outlook for sub-Saharan Africa. Real GDP is now forecast to contract by 3.2 percent in sub-Saharan Africa, double the contraction envisaged in April.

The downward revision of the growth projections reflects the impact of domestic measures to contain the COVID-19 outbreak, as well as a weaker external environment, the IMF says in its latest Regional Economic Outlook Update: Sub-Saharan Africa. On average, per capita incomes across the region will fall by 5½ percent in 2020, back to levels last seen nearly a decade ago.

This will likely lead to more poverty and widen income inequality as lockdowns disproportionally affect informal sector workers and small- and medium-sized companies in the services sectors. The region’s outlook is subject to much uncertainty. “Regional policies should remain focused on safeguarding public health, supporting people and businesses hardest hit by the crisis, and facilitating the recovery,” says Abebe Aemro Selassie, Director of the IMF’s African Department. Here are six charts that tell the story:

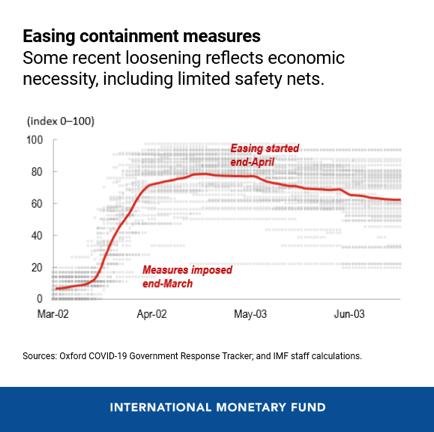

- Containment measures were taken to safeguard public health Shortly after the region’s 100th case on March 15, many country authorities proactively implemented strict containment measures to control the COVID-19 outbreak. These measures led to more people staying home and reducing daily movements to areas with services and recreational facilities, including the informal economy. The growth of new cases has slowed somewhat since, and a number of countries have cautiously eased some of their containment measures. But region-wide the pandemic is still in its exponential phase, with more than a quarter-million confirmed cases, and infection cases doubling every 2-3 weeks.

- The external environment is less favourable Since April, global growth for 2020 has been revised down by 1.9 percentage points to –4.9 percent; global travel has collapsed and tourism flows have grounded to a halt; remittances are expected to fall by about 20 percent; external financing conditions remain tight despite some easing in recent weeks; and commodity prices remain low.

- The contraction in 2020 is now expected to be stronger than envisaged in April The regional economy is projected to contract by 3.2 percent in 2020, which is 1.6 percentage points deeper than projected in April. Growth was revised down for 37 countries out of 45. Tourism-dependent economies, oil-exporting countries and other commodity exporters have seen larger downward revisions. Growth in SSA is projected to recover only gradually, assuming that the pandemic abates and lockdowns ease in the second half of 2020. In 2021, regional growth is projected at 3.4 percent, which is 0.6 percentage points below the April 2020 projection.

- The COVID-19 crisis is set to wipe out nearly 10 years of progress in development Real per capita GDP in the region is projected to contract by 5.4 percent in 2020. This will bring the per capita GDP almost back to its level in 2010. COVID-19 is set to increase extreme global poverty for the first time in decades, with 26-39 million people thrust into extreme poverty in sub-Saharan Africa alone.

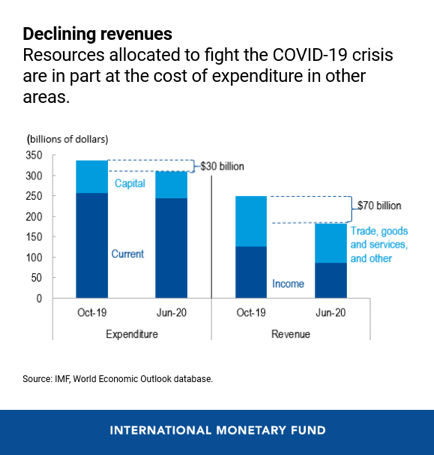

- Timely fiscal support is crucial, but many authorities are constrained The preservation of health and lives remains the priority. Most country-authorities have allocated more resources to healthcare and virus containment measures, and to support vulnerable households. However, many authorities are constrained in their ability to increase spending to mitigate impacts of the crisis.

- More international support is urgently required for sub-Saharan Africa International financial institutions, including the IMF, have provided much-needed assistance to sub-Saharan Africa. On April 15, the G20 announced the Debt Service Suspension Initiative (DSSI), which allows the world’s poorest countries — most of them in Africa — to suspend up to US$14billion of debt service payments due in 2020. Despite this, countries across Africa still face financing needs amounting to over US$110billion in 2020, with US$44billion still having to be financed.