Key Issues

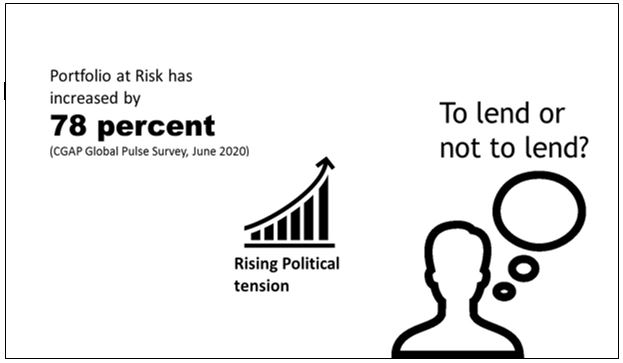

- The adverse impact of COVID-19 on credit markets has been devastating. Several non-bank financial institutions have reported a deterioration in portfolio quality.

- The advent of presidential and parliamentary elections in December 2020 has brought in its wake intense political rhetoric that may create uncertainty in the outlook, causing asset allocators to take refuge on safe instruments as opposed to deploying capital in the real economy.

As political tensions in the country intensifies, concerns about market volatility in the outlook is rising as well. Notwithstanding Ghana’s enviable record of holding successful elections characterized by peaceful transitions, political risk concerns always seem to drive capital allocation decisions, particularly in election years.

The 2020 election will obviously be a hotly contested race between the two dominant parties, NDC and NPP. For both sides, the stakes are very high – so high that none of the contenders are prepared to cede space or concede an argument, whether on matters of public policy or manifesto promises.

Amid the rising tension, very little consideration has been given to the potential impact on the credit markets and the consequential effect on economic recovery post-COVID. Our own thesis is that if the tension continues to build up without early interventions from well-meaning civil society organizations, dislocations in the credit markets will be one of several risks to growth outlook that may delay a full scale rebound from the devastating impact of the Corona virus pandemic.

Already credit portfolios across several geographies have showed signs of distress due to the impact of COVID-19. This is attested to by data from several research organizations. For instance, a recent study by Consultative Group to Assist the Poor (CGAP), 180 microfinance businesses across the globe were surveyed with 41 percent of respondents coming from sub-Saharan Africa.

The report found that the global average of Portfolio at Risk over 30 days (PAR30) increased by 78 percent (July 2019: 4.1 percent; April 2020: 7.2 percent) among survey respondents. For details see the CGAP weekly Global Pulse Survey. In Ghana, credit to private sector is also showing signs of deceleration. By February 2020, there was a marginal decline, year-on-year, in private sector share of credit from 90.7 percent to 87.5 percent. This is in spite of the growth in net loans and advances by 27.2 percent for same period.

The Central Bank in its March 2020 Banking Sector Report, expressed legitimate concerns about the potential impact of COVID-19 on bank’s operating assets, in spite of the growth rebound in gross loans and advances by 26.0 percent as at February 2020 (February 2019: 1.9 percent). To moderate the impact, monetary policy measures that sought to release capital and liquidity buffers were implemented by the regulator to incentivize credit growth.

That notwithstanding, and granted that effective monitoring by the regulator will be able to course-correct deviations by the banks such as investing in government securities, the potential impact on asset quality cannot be discounted as banks may be forced to off-load excess liquidity by lending to counterparties whose creditworthiness may deteriorate with increasing risks from the political environment as we head to election in December 2020.

This we believe will create disincentives that may dissuade financial sector operators from deploying capital in the real economy. “Why lend now when the outlook is uncertain” may be a fair rhetorical question for the credit committee. If at all, it may be prudent to lend at short tenors, or smaller ticket sizes, all of which reduces a financial institution’s risk exposure but may exert cash flow pressure on borrowers across board.

Politics or Policy: What is really at stake?

There is excitement in the air, (or fear, depending on where you belong), as December draws near, ushering in another session of democratic accountability after four years of public service by the incumbent government. For many it is politics as usual, characterized by sloganeering, social media marketing, and in some cases, “vote-buying”. Unfortunately, the prevailing narrative fails to capture the concerns of a key economic constituent, financial services. Having just come out of a painful regulatory reform, the sector cannot afford to sail into new headwinds without risking heavy attrition to its balance sheet.

For actors in the financial services sector, what is really at stake is a stable macroeconomic environment; lower debt-to-GDP, low inflation expectation, positive net foreign assets reserves, efficient domestic revenue mobilization, etc. – all of which affect business and consumer confidence, thereby driving spending and growth. This fact seem lost in the current political debate. This is not to suggest that issues of electoral practice is less important, for it is the vehicle through which the broader outcomes will be delivered. However, as a people, our collective burden is to reach consensus on this basic question: how can the interest of all constituents, political and apolitical, be balanced in fashioning out a clear policy agenda that prioritizes macroeconomic stability without diminishing the importance of other democratic considerations?

Final Thoughts

Taking into consideration that the full impact of the Corona virus pandemic on portfolio quality will be known by Q3, we venture to argue, that the heightened political tension could negate the potential benefits of liquidity releases that were announced by the regulator in Q1 2020. The media and other civil society organizations must play a role in diffusing the tension by focusing the debate on key policy issues such as growth, inequality and human dignity.

About Metis Decisions Limited

We provide training, strategy consulting and market research for corporate clients. Visit us http://metisdecisions.com