The financial services industry is leading the drive to slow down the spread of the Covid-19. Operating a cash-lite society has become a key target of central banks globally; and it is poised to change banking and the customer experience forever. At Bloomberg Invest Global 2020, a virtual conference hosted by Bloomberg News earlier last week, Ecobank Group’s CEO Ade Ayeyemi reported that the bank was seeing 95% of transactions done on digital platforms since the pandemic started. In his words, the virus “has become the greatest accelerator of the adoption of digital”.

The impact of Covid-19.

At the global level, economic disruption from the Covid-19 outbreak is expected to lead to recession in some countries, as industrial production, investment, retail sales, and services production contracted sharply in China in Q1.

The World Bank projects that economic growth in Sub-Saharan Africa will decline from 2.4 percent in 2019 to between -2.1 per cent and -5.1 per cent this year. This would be the first ever recession in SSA since 1995. In Ghana, the government revised its GDP growth rate from 6.8 per cent to 1.5 per cent. Fiscal deficits are projected to widen amid falling government revenues due to falling oil prices, reduced activity in the tourism industry and the uncertainties surrounding commodities.

In the current crisis, there are immediate actions banks can take to help retail and small-business owners; banks have given a breather to loan servicing customers in distress due to the pandemic. Banks are also using their digital channels enable customers can bank from home, especially customers who have struggled to embrace digital solutions.

What will be the new normal?

A key conundrum for executive management and leadership is determining which changes occasioned by the pandemic will become permanent, and which changes will not be. To illustrate the importance of this differentiation, we will site the example of a Cinema, in comparison to movie streaming service. Online streaming services are benefiting from the restrictions caused by Covid-19 as people are advised to stay away from enclosed places such as cinema halls.

It is however expected that when a vaccine or cure is found, movie watchers would want to return to the cinema. Customer insight shows that most people who go to watch a movie at the cinema do so because they want to socialize. That value proposition of socialization is unmatched by streaming services.

In contrast, an industry such as healthcare is witnessing the adoption of telemedicine by consumers as a permanent fix. A lot of patients were skeptical about telemedicine until Covid-19 forced them to experiment it, and most are likely to adopt it as a preferred choice for receiving healthcare. In the financial services industry, leaders and strategists must be able to map their customer experience and determine which significant changes occasioned by Covid-19 will become the new normal.

Disruption of banking and financial services:

Unlike the last global crisis which had banks as the protagonists, the solutions to this current crisis will be led by Banks. Banks however face a new set of competition; competition from their peers and from beyond. The field of competitors has widened beyond traditional banks to include Telcos, Technology giants and Fintech. We are in times where consumers of financial services will now do most of their banking through disruptors who may not be banks.

-Telcos

In Ghana, telcos have been able to ride on the back on mobile phone penetration reach a large base of customers with their financial transaction services. With over 22.6m voice subscribers as of December 2019, MTN has been able to disrupt the movement of cash for payment. Within 11 years of operating its Mobile Money service, the telecom company has been able to open 15.1m mobile money accounts, with 9.1m active, and has as merchants 123k and 153k agents.

This translated into revenues of GH¢1billion 2019 alone. The telcos are not relenting and have started venturing into pensions and loan offerings for clients, in partnership with financial institutions. Its activities in what it terms advanced services (i.e. in remittances, microloans, pensions etc.) have been up 77% from 2018 to 2019, per the company’s investor presentation. With advances in Artificial Intelligence, Machine Learning and improved KYC structures, telcos may become better personal loan risk analysts.

-Multinational Technology Giants

Technology firms such as Facebook, Uber, Apple, Google, Amazon, Paypal; having built their brands in their various industries are now disrupting financial services. These companies are riding on the back of customer data collected over the years to offer financial services and reward systems to customers in ways that a standalone bank may not be able to do.

A few of these disruptions are:

- Uber Cash which can be used to pay for rides, and food orders with Uber Eats.

- Apple Pay which is using the near-field communication (NFC) chips embedded in the iPhone and Apple Watch to pay for goods and services by holding the device near a card reader. It can also be used to make single touch purchases within apps.

- Facebook is also rolling out Facebook Pay which will provide people with a convenient, secure and consistent payment experience across Facebook, Messenger, Instagram and WhatsApp. This payments feature lets customers connect Visa or Mastercard debit card and tap a “$” button to send friends money on iOS, Android, and desktop with zero fees.

In our research, we found that these multinational technology disruptors are willing to charge no fees and make losses on their payments solutions. However, this so called free services they provide offers them such enormous amounts of data on their users, which they mine for customer insight.

-Fintech Disruptors

Another key component of the financial systems ecosystem has been Fintech companies. According to the Bank of Ghana, there were 71 registered Fintechs in Ghana as at 2018. In the past year, the central bank passed the Payment Systems and Settlement Bill into law.

The Africa tech sector’s attractiveness to investors is the highest it has ever been. In the past year, 234 African tech start-ups raised a total of US$ 2.02 billion in 250 equity rounds, compared to US$1.2 billion in 2018. Of this amount, Fintech startups attracted 55 per cent of the capital raised. The attractiveness of Fintech startups to investors is unprecedented and would be further heightened with the systemic changes the pandemic is causing.

How do you navigate in uncertain times and build a competitive advantage

Innovation has become trendy and rightly so. Almost every bank is pushing to be “digital”. Leadership of organizations must be able to cut through all the information it receives and keep the firm focused on what its goals and aspirations really are. The momentum of change makes this a daunting task, but a necessary one to keep the firm aligned. Innovation is not just about finding new things to do, but also new ways of doing old things efficiently. The organization does not necessarily need to release new products, but more importantly find ways to make the old ones efficient and cost effective.

In our recommendations for growing innovation, we focus on three main pillars:

-Leadership

The role of leadership is to define the aspirations of the organization and provide the tools (human, financial and structures) needed to achieve innovation that creates real value at scale. Most senior executives agree that people and culture are key drivers of innovation. In the situation where an organization is involving external partners in achieving innovation, the need to ensure a cultural synch is vital.

Leadership must ensure it can feel the pulse of the marketplace and build agile teams that have a mindset of the endless possibilities to create value within the organization and for its stakeholders. Leadership must create a culture of intrapreneurship where employees are fully engaged and able to showcase their ideas and take initiative.

-Cross Function Collaboration

Now more than ever, companies have adopted the use of technologies in boosting productivity and collaborating on projects. Organizations have to derive value from cross function collaboration within their ranks. Customer facing functions and back office teams have to learn to work together and ensure that the customer experience journey is clearly defined.

Product development teams must work with big data, analytic tools and all functions within the organization and its partners to ensure the value propositions enshrined in their products and services are attainable and relevant to customers. A key competitive advantage for service delivery must be the ability to collaborate within the organization.

Video conferencing (which includes screen sharing) has become a mainstay during these Covid-19 times, and we envisage it will become a necessary tool going forward. Bank management should utilize technology to push a cross-functional agenda within their organizations.

Fintech Partnerships

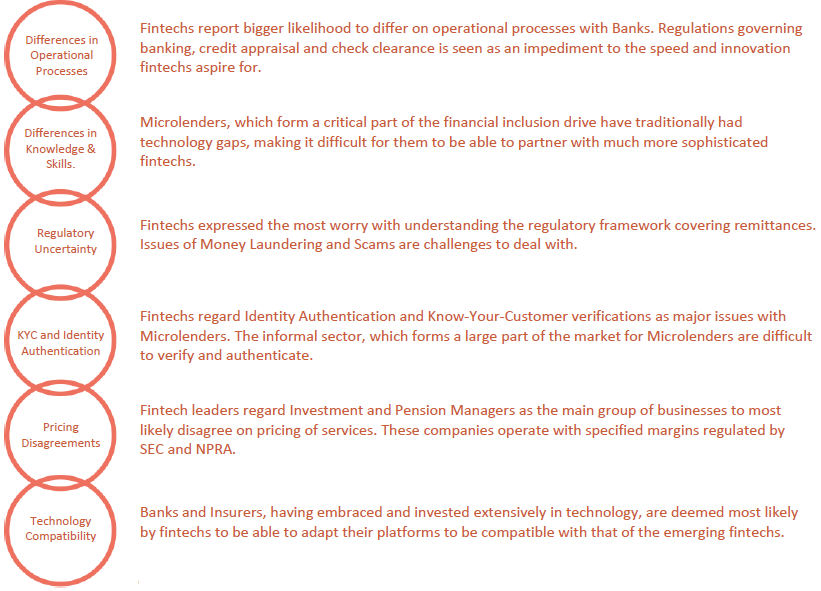

Banks should partner Fintech companies and other disruptors in order to have a competitive edge in financial innovation. In a research we conducted last year, Fintech CEOs pointed to the following factors as posing challenges to collaboration between Fintech companies and incumbent financial institutions:

- Technology Compatibility –Legacy technology limitations

- Pricing Disagreements

- KYC and Identity Authentication Standards

- Regulatory Uncertainty

- Differences in Operational Processes

- Differences in Knowledge & Skills.

- Differences in management and culture

We developed this matrix on the collaboration gaps:

Financial institutions need to determine their balancing act, to efficiently recognize the shortcomings of Fintechs and other players within the financial services ecosystem, and adapt appropriately.

Organizations such as MTN and Ecobank have in the last year made available their API Sandboxes for developers, where ideas and solutions can be tested in a safe environment, with live data while ensuring utmost security of data.

The Ecobank Group is leveraging this arrangement by launching its Pan-African Banking Sandbox that will allow partners and fintechs across 33 African countries gain access to its Application Programming Interface (API) to develop innovative financial solutions. This is in furtherance of their strategy to support innovation by launching Fintech Competitions.

A winning strategy in the new normal will have to incorporate solutions that address the peculiarities of our largely informal economy with its attendant problems with identity verification and addressing system.

Conclusion

This pandemic has accelerated the adoption of digital solutions in creating impressive customer experiences and in boosting organizational efficiencies.

For the protection of future revenue and to remain relevant, it is essential to undertake payments transformation initiatives with the understanding that the Return on Investment (ROI) may not be directly and immediately visible. Financial institutions must find ways to apply data analytics to data generated from customers and their digital footprints to offer personalized and customized services to these newly defined customer segments to recoup their investments.

Organizations will have to understand the customer experience journey, and map how the current circumstances and technologies available to them can be able to offer the best value proposition to its customers. It must also look at how the investments in these technologies can increase its bottom-line and delight its shareholders.

The writer

Bubune K. Sorkpor is a corporate strategist and fintech enthusiast. He has consulted banks and for organizations looking to understand new technology ecosystems, and is currently pursuing a master’s degree in Innovation and Entrepreneurship.