The University of Cape Coast School of Business has organised a virtual seminar to educate students on tax reliefs and financial reporting implications.

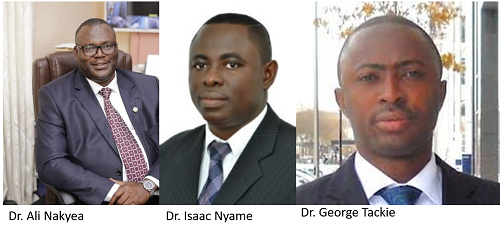

The e-seminar, themed ‘Coronavirus Pandemic, Tax Reliefs and Financial Reporting Implications’, had Dr. Abdalah Ali-Nakyea of Ali-Nakyea & Associates; Dr. Isaac Nyame of Ikerm and Associates’ and Dr. George Tackie, Head, Department of Accounting, as discussants.

Speaking at the seminar, Dean of the UCC Business School, Prof. John Gatsi, rued the impact that coronavirus pandemic has had on various business activities, including cancellation of planned AGMs – saying they are crucial in the fiscal and strategic life- cycle of companies as they provide unique opportunities for shareholders to assess the performance of their companies and managements by evaluating the financial statements.

He called for creativity and engagement by professional bodies in accounting, taxation, auditing, regulatory institutions and government to deal with emerging challenges. Prof. Gatsi said innovation should lead the way to ensure that the golden role assigned to shareholders through AGMs to promote good corporate governance and make strategic decisions to foster the going concern of businesses is not truncated due to the pandemic.

He further stated it is encouraging that some companies and banks have announced virtual AGMs; adding the deadline for AGMs, either through virtual or the traditional approach, should be concluded early so as to limit possible corporate governance abuses in the absence of an AGM.

Dr. Ali-Nakyea explained the importance of various tax reliefs granted and threw light on the difference between tax waivers and tax exemptions. He explained that the purpose of tax exemptions is to benefit the country in terms of job creation, technology transfers, export of products and services.

He further called on citizens to question tax exemptions in Ghana, especially as they serve as critical incentives for both domestic and foreign businesses. He further advised that where there are tax exemptions, such as free zones, companies must adhere to conditions precedent to granting the free zone licences.

Dr. Tackie, on his part, also advised that in the era of a pandemic, the requirement for proper book-keeping should be enhanced because stakeholders will depend on the statements for various decision-making.

He emphasised the need for professionals such as accountants and auditors to meet their duty to maintain quality professional engagement; as with or without the coronavirus pandemic, the role played by credible financial statements will not change.

Dr. Tackie further warned that the cancellation of dividends by banks and moratorium on payment of interests have serious implications for financial reporting which must not be taken for granted.

Adding his comment, Dr. Nyame said it is necessary for the Ghana Revenue Authority to continue collecting tax revenue during the pandemic, since expenditure burden on the state does not reduce because of the pandemic.

He advised tax payers to enhance proper record-keeping, because after the pandemic intensive tax audits will take place to unearth tax payment abuses which might have taken place.