The COVID-19 pandemic has caused an unprecedented human and health crisis. The measures necessary to contain the virus have triggered an economic downturn. At this point, there is great uncertainty about its severity and length. The latest Global Financial Stability Report shows that the financial system has already felt a dramatic impact, and a further intensification of the crisis could affect global financial stability.

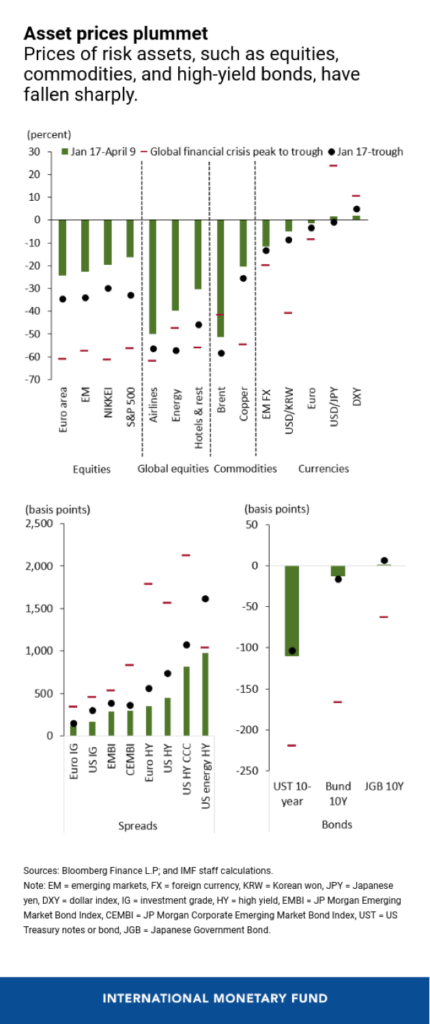

Since the pandemic’s outbreak, prices of risk assets have fallen sharply: At the worst point of the recent selloff, risk assets suffered half or more of the declines they experienced in 2008 and 2009. For example, many equity markets—in economies large and small—have endured declines of 30 percent or more at the trough. Credit spreads have jumped, especially for lower-rated firms. Signs of stress have also emerged in major short-term funding markets, including the global market for U.S. dollars.

Market strain

Volatility has spiked, in some cases to levels last seen during the global financial crisis, amid the uncertainty about the economic impact of the pandemic. With the spike in volatility, market liquidity has deteriorated significantly, including in markets traditionally seen as deep, like the U.S. Treasury market, contributing to abrupt asset price moves.

To preserve the stability of the global financial system and support the global economy, central banks across the globe have been the first line of defense. First, they have significantly eased monetary policy by cutting policy rates—in the case of advanced economies to historic lows. And half of the central banks in emerging markets and lower income countries have also cut policy rates. The effects of rate cuts will be reinforced through central banks’ guidance about the future path of monetary policy and expanded asset purchase programs.

Second, central banks have provided additional liquidity to the financial system, including through open market operations.

Third, a number of central banks have agreed to enhance the provision of U.S. dollar liquidity through swap line arrangements.

And finally, central banks have reactivated programs used during the global financial crisis as well as launched a range of new broad-based programs, including to purchase riskier assets such as corporate bonds. By effectively stepping in as “buyers of last resort” in these markets and helping contain upward pressures on the cost of credit, central banks are ensuring that households and firms continue to have access to credit at an affordable price.

To date, central banks have announced plans to expand their provision of liquidity — including through loans and asset purchases—by at least $6 trillion and have indicated a readiness to do more if conditions warrant.

As a result of these actions aimed at containing the fallout from the pandemic, investor sentiment has stabilized in recent weeks. Strains in some markets have abated somewhat and risk asset prices have recovered a portion of their earlier declines. Sentiment continues to be fragile, however, and global financial conditions remain much tighter compared to the beginning of the year.

All in all, the sharp tightening of global financial conditions since the COVID-19 outbreak—together with the dramatic deterioration in the economic outlook has shifted the one-year-ahead distribution of global growth massively to the left. This points to a significant increase in downside risks to growth and financial stability. There is now a 5 percent likelihood (an event that happens once every 20 years) that global growth will fall below -7.4 percent. For comparison, this threshold was above 2.6 percent in October 2019.

As so often happens at times of financial distress, emerging markets risk bearing the heaviest burden. In fact, emerging markets have experienced the sharpest portfolio flow reversal on record—about $100 billion or 0.4 percent of their GDP—posing stark challenges to more vulnerable countries.

The global spread of COVID-19 may require the imposition of tougher and longer- lasting containment measures—actions that may lead to a further tightening of global financial conditions should they result in a more severe and prolonged downturn. Such a tightening may, in turn, expose financial vulnerabilities that have built in recent years in the environment of extremely low interest rates. This would further exacerbate the COVID-19 shock. For example, asset managers facing large outflows may be forced to sell into falling markets—thus intensifying downward price moves. In addition, levered investors may face further margin calls and may be forced to unwind their portfolios; such financial deleveraging may aggravate selling pressures.

As firms become distressed and default rates climb higher, credit markets may come to a sudden stop, especially in risky segments like high yield, leveraged loan, and private debt markets. These markets have expanded rapidly since the global financial crisis, reaching $9 trillion globally, while borrowers’ credit quality, underwriting standards, and investor protections have weakened. Since early March, high-yield spreads have skyrocketed notwithstanding recent declines, particularly in the sectors most affected by the pandemic like air travel and energy. Similarly, leveraged loan prices have fallen sharply—about half the drop seen during the global financial crisis at one point. As a result, ratings agencies have revised upward their speculative- grade default forecasts to recessionary levels, and market-implied defaults have also risen sharply.

Banks have more capital and liquidity than in the past, and they have been subject to stress tests and greater supervisory scrutiny in recent years, putting them in a better position than at the onset of the global financial crisis. In addition, the substantial and coordinated action by central banks to provide liquidity to banks in many economies should also help alleviate potential liquidity strains.

Nonetheless, the resilience of banks may be tested in the face of a sharp slowdown in economic activity that may turn out to be more severe and lengthy than currently anticipated.

Indeed, the large declines in bank equity prices since mid-January suggest that investors are concerned about profitability and prospects for the banking sector. For example, measures of bank capitalization based on market prices are now worse than during the 2008 global financial crisis in many countries. The concern is that banks and other financial intermediaries may act as an amplifier should the crisis deepen further.

Looking ahead

Central banks will remain crucial to safeguarding the stability of global financial markets and maintaining the flow of credit to the economy. But this crisis is not simply about liquidity. It is primarily about solvency—at a time when large segments of the global economy have come to a complete stop. As a result, fiscal policy has a vital role to play.

Together, monetary, fiscal, and financial policies should aim to cushion the impact of the COVID-19 shock and to ensure a steady, sustainable recovery once the pandemic is under control. Close, continuous international coordination will be essential to support vulnerable countries, to restore market confidence, and to contain financial stability risks. The IMF is ready to assert the full weight of its resources—first, to help protect the world’s most vulnerable economies, and, for the long term, to strengthen the eventual recovery.

Tobias Adrian is the Financial Counsellor and Director of the Monetary and Capital Markets Department. Fabio M. Natalucci is a Deputy Director of the Monetary and Capital Markets Department