The application of public private partnership (PPP) in infrastructural development have been adopted in the water sector, aviation, road sector, energy sector and telecommunication sector in Ghana.

Thus, the involvement of the private actors with various government agencies in the delivery and infrastructural development is not a new phenomenon in the country. We would have expected more PPP arrangements of projects, but evidence from various project data, clearly shows low participation of private actors’ partnership with government in relation to critical public service delivery and infrastructures such as aviation, transport sector, railways, telecommunication, and hospitals.

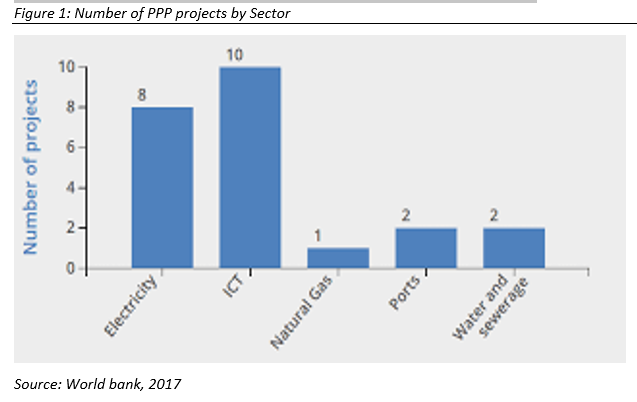

Rather government have solely managed public projects mainly financed by government revenues and international donor supports (World Bank, 2016). The development and implementation of PPPs remains at a nascent stage in Ghana. The World Bank’s Private Participation in Infrastructure Database lists 23 projects that reached financial close over 1990–2014, of which eight are independent power producer (IPP) projects (figure 1).

The independent power producer (IPP) projects included the CenPower Generation Company Ltd which was set up as a special purpose vehicle (SPV) to develop the Kpone Independent Power Plant (KIPP) project in the Tema Industrial Zone. The project is a 350-megawatt power station, which accounts for approximately 10 percent of Ghana’s installed capacity and 20 percent of the available thermal generation capacity when it came on stream in 2017. Other than IPPs, the country has successfully operationalized other PPP project, the Teshie Nungua Water Desalination project for instance is a PPP arranged projects. Now the current government is currently reviewing PPP projects in the various sectors to help address the infrastructural gap faced by the country.

Although the number of projects on the ground remains small, the Government of Ghana has identified PPPs as an important mode for financing infrastructure, given that the country’s infrastructure and capital project needs are expected to reach US$12 billion in new financing by 2025.

The low patronage of private investment partnership with government in the delivery of infrastructural development It has therefore become necessary in recent times for the government to engage the private sector to assist in the delivery of more physical public infrastructures, following the global financial crisis which has limited the flow of donor funds. PPP actually became a national policy in 2004, with a launch of a national policy guideline (MOFEP, 2011).

Therefore, this article assesses analytical issues in the country’s PPP by reviewing the motivation factors and challenges that needs to be addressed to ensure the successful implementation of PPP projects in the various sectors of Ghana. Subsequent to this preamble is the fundamental factors pushing for the execution of PPP projects in Ghana. The next segment investigates the critical challenges faced by stakeholders in the implementation of PPP projects in Ghana. The last section gives a conclusion on the various themes discussed in the acticle.

Reasons for Implementing PPP in Ghana

In recent times, there have been a clamor call for the adoption of PPP arrangement in the financing and implementation of projects in Ghana (Osei- Kyei et al. 2017). It is very critical for the general public and relevant stakeholders to appreciate the motivating factors in the selection of PPP approach in the management of a project. This section attempts to discuss three (3) critical reasons promoting the application of PPP concepts in the management and financing of projects in Ghana.

- Promotes the speedy provision of public infrastructure

One of the key challenges faced by governments in the execution of projects is financial capital to fund the projects in Ghana. It is mostly expected that a PPP arrangement will optimize the finance and speedy execution of project. The reason been that most PPP projects are mostly effectively planned, and the design and execution of the projects are properly laid out with timelines in the contract.

Additional, whatever capital injection made by the private investors; they will always ensure the timely delivery of projects so they can recuperate whatever funds they injected into a project, so timely delivery of PPP projects is assured. For instance, in the energy sector we have the Sunon Asogli Power Plant, a typical PPP at work, which produced fifteen per cent of the total electricity generated in the country (200 megawatts of power) in 2011.

Figure 2: 360 MW Asogli Power Plant

- Reduces government financial Difficulty

The World Bank has projected that approximately USD 1.5 billion is needed annually to closed the infrastructure financial gap in the next decade in Ghana; thus, it has become imperative for the government to pursue supplementary funding for public projects through alternative financing option.

Cursory look at figure 3, shows over 600 public projects in Sub-Saharan and Africa in general; PPP funded projects have contributed over seven hundred billion in investment. The PPP concept is hence seen as the groundbreaking financing and management approach to make use of private finance in public infrastructure delivery in Ghana and Africa in general.

Figure 3: Number of Projects and Total Investment

- Allows for shared risk

Normally, risk sharing is an analytical element of projects managed under a PPP management and fundamentally all risks are transferred to the private investor. This consequently lessens government risks and costs acquired in the delivery of the public services and infrastructural developments.

Hence the benefits of a project under PPP arrangement allows the private investor to inherit the risks identified in the execution of the projects whilst government can now concentrate on other projects in other sectors. Allocating risks in PPPs, however, is inherently challenging. Risk transfer to the private sector comes at a price, and transferring risks that the public agency is better able to manage is likely to erode VFM

Identified Challenges in PPP Project execution in Ghana

PPP execution in Ghana faces many challenges as comprehended in numerous other third world countries. Fundamentally, the barriers curtail from numerous phases which commences from socio-political to structural working environments of PPP execution in the various sectors. There are two key factors affecting the successful implantation of PPP projects in Ghana; namely lack of PPP practitioners in the country and misallocation and incomplete transfer of risks.

- Lack of experienced PPP practitioners

Many PPP projects in Ghana failed as a result of inexperience personnel to handle PPP projects in the country. As a substance of fact, most indigenous PPP decision-making practitioners both government actors and private actors in Ghana have very diminutive knowledge in handling PPP transactions and delivery of projects. The majority of PPP practitioners both government actors and private actors in Ghana are more conversant with the conventional financial method equated to PPP application, and this has contributed essentially to the sluggish speed of execution of PPP projects in Ghana.

- Misallocation and incomplete transfer of risks

The concept of risk allocation in PPPs is relatively straightforward: risks should be allocated to the party best able to manage them. In other words, the party that is best able to understand a risk, control the likelihood of the risk occurring and/or minimize the impact of the risk should also be responsible for managing it. But we realized that in Ghana, the public actors handle majority of the risk associated to PPP projects in Ghana which leads to failure in the execution of the project since public officials do not understand the risk and not able to manage the risk associated to the PPP projects.

Conclusion

PPPs have gotten off to a relatively slow start in Ghana, but they are increasingly used for large-scale infrastructure and public works projects. Many PPP projects in recent decades have been extremely successful. The high-occupancy toll lanes project in Accra – Kumasi roads, Accra – Takoradi roads are a good example. Several private sector firms participated in this partnership, resulting in cost savings in the millions of dollars. In addition, the collaboration between government and private partners brought expanded highway capacity years earlier than a traditional government-does-all approach might have done.

>>the writer is a Researcher and Public Policy Analyst with considerable knowledge and expertise in Public Private Partnership, Leadership inspiration and Public Policy formulation. He is currently a Senior Management Consultant, Gimpa Consultancy and Innovation Directorate (GCID), the Consulting Division of the Ghana Institute of Management and Public Administration (GIMPA). Contact the Author on 0205012686 / [email protected]