“Connecting this to the case of Ghana, it implies that if there are any cross-cancellation clauses agreed on under Ghana’s debt contracts with Chinese lenders, mining in the Atewa Forest is likely to go ahead no matter the pressure from the various stakeholders.”

One of the topical issues surrounding Africa’s economy is its rising debt crisis. Most people do not really understand the debt crisis but have only come to accept that borrowing too much is a problem that has to stop. But what is the big deal? After all, even the almighty United States has a debt pile in the trillions of dollars. Well, when we say “all fingers are not equal”, the same is true of debt.

The argument that Western countries like the United States have higher Debt to Gross Domestic Product (GDP) ratios than many African countries – and thus Africa is not an outlier – is one that seeks to tell only one side of the story. But as Chimamanda Ngozi says, “there is a danger in telling a single story”. The size of debt matters just as much as who owns the debt (the creditors of the country) and something that is rarely discussed – the terms and conditions of the debt. Much of the conversation around debt in Africa has been about its growing size and very little about the terms and conditions under which African countries borrow. We all know the devil is in the details. In this article, I would like to throw some light on how the world’s largest creditor, China, lends to Africa.

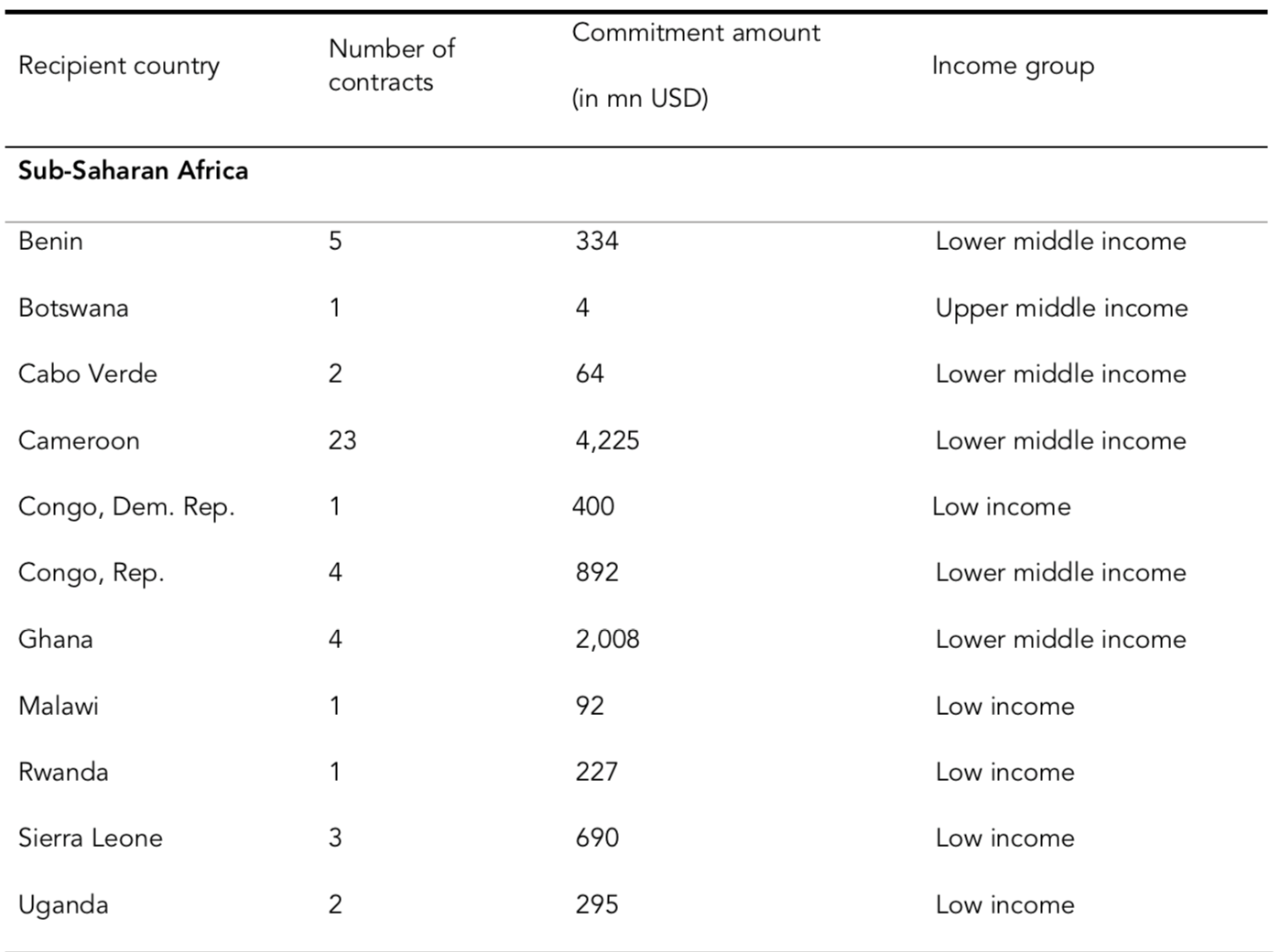

A recent publication by AidData offered readers the rare opportunity of discovering the intricacies of China’s module for lending to developing nations. The researchers focused on Chinese loans to 24 developing nations: 11 of them being from the African continent (see figure 1 below), one of which was Ghana. China remains tight-lipped about its dealings with other countries, and that has always been a point of contention between China and the Western world.

With very little transparency on the nature of loans given to developing countries, accountability is swept under the carpet on both the side of China and the borrowing government. African countries are not debtors to China alone, so there is reasonable cause for other creditors to be concerned about the nature of China’s dealings with Africa. Without transparency, the true state of affairs and the creditworthiness of a borrower cannot be impartially determined. The report by AidData uncovered some terms and conditions which might give an indication of why China is able to lavish Africa with loans.

Figure 1. Breakdown of China-Africa Debt Contracts represented in the study

Source: aiddata.org Confidentiality

“The Borrower shall keep all the terms, conditions and the standard of fees hereunder or in connection with this Agreement strictly confidential. Without the prior written consent of the Lender, the Borrower shall not disclose any information hereunder or in connection with this Agreement to any third party unless required by applicable law.”

This is the clause issued by the China Eximbank in all its contracts with borrowing countries post 2014. Similar clauses can be found in all China Development Bank (CBD) contracts as well. This limits debtors in their engagement with stakeholders and might lead to falsely drawn conclusions about a country’s state of affairs. The citizenry who are actively involved in the public discourse may also be missing out on critical information of how their government borrows.

However, it must be noted that confidentiality clauses are not unique to China alone. There are other lenders who have similar clauses in debt contracts but which are not as extensive as the Chinese. The phrase “unless required by applicable law” is a grey area, which is most likely defined by what the Chinese lenders would consider as applicable law or otherwise.

Collateral ties

It is safe to say the Chinese do not leave the negotiation table without a clear plan and commitment from borrowers on how to pay back loans. This is guaranteed by the agreement to create special accounts with banks at the discretion of the lender, which informally acts as a safety net for the Chinese in case there are any risks of default. As a condition, these accounts are regularly funded with proceeds from projects either associated or unrelated to the main project(s) for which the loan was sought for.

You might recall the US$2billion deal Ghana signed with China which apportions 5% of Ghana’s bauxite reserves to China in exchange for infrastructure projects. That was a typical example of how revenue from projects unrelated to loans given is used as collateral. This further explains the reluctance from the Ghanaian government to discontinue the mining activities.

We have seen calls from environmental activists and twitter campaigns with the various hastags- #SaveAtewaForest, #SaveAtewa4Water, #AtewaForest – with the aim of bringing to light the potential impact of mining activities on the unique biodiversity of the Atewa Forest and the pollution of water-bodies which serve as a source of drinking water for 5 million Ghanaians. Global companies which ordinarily would have been Ghana’s customers for bauxite have also joined the conversation with their usual virtue-signalling – making public statements of their opposition to mining in the area. Again, it must be noted that this type of debt contract provision is not only used by the Chinese; but it is not as common in bilateral and multilateral lending between developing nations and sovereign lenders.

The Paris Club Clause Exclusion

“The Borrower hereby represents, warrants and undertakes that its obligations and liabilities under this Agreement are independent and separate from those stated in agreements with other creditors (official creditors, Paris Club creditors, or other creditors), and the Borrower shall not seek from the Lender any kind of comparable terms and conditions which are stated or might be stated in agreements with other creditors.”

This is the only clause that is unique to how The Paris Club lends to developing nations, and there is an interesting reason why. The Paris Club refers to a group of official creditors who work together to provide debt contract conditions to their debtors who may be faced with a crisis and default risks. Paris Club members are guided by the principle of debt treatment comparability to ensure there is fairness in how lenders share the burden of risk.

This simply means, for example, if both Brazil and Canada have given loans to Ghana and there happens to be a risk of default, the Paris Club conditions guarantee that Brazil’s debt contract with Ghana does not receive preferential treatment compared to that of Canada’s and vice versa. Another aspect of the Paris Club role is the provision of debt-relief to debtors in the form of rescheduling payment of loans and reduction in debt-service obligations.

It becomes a more complex issue when we also note that the Paris Club condition of debt treatment comparability further applies to debt contracts between their debtors and other non-Paris Club members, something that does not sit well with the Chinese lenders. In the report by AidData, it was noted that 74% of Chinese lenders do not adhere to this principle.

Cross-Default and Cross-Cancellation Clause

Simply put, the cross-default clause means that if Ghana defaults under its debt contract with the Party A, any other creditor to Ghana, say Party B, has the right to terminate and demand full principal and accrued interest payable. The cross-default clause is a standard clause common in all commercial debt contracts, so it is not only used by Chinese lenders.

However, other variations of the cross-default clause used by Chinese lenders allows them to terminate and demand payment if there are any risks to other investment interests of any ‘PRC (People’s Republic of China) entity’ in the borrowing country, where ‘PRC entity’ is broadly defined. It also appears that the CDB uses loans as a tool for policy influence in debtor countries. This is particularly dangerous because it reduces government autonomy in making independent decisions without external influence. The cross-cancellation clause ties the provision of a loan for a particular project to the successful delivery of other projects linked to loans given by the lender.

The CDB has triggered this clause in the past when dealing with Argentina, on the basis that a newly-elected government decided to discontinue a pre-agreed US$4.7billion syndicated loan from Chinese banks to build two hydroelectric dams due to environmental concerns raised. Needless to say, the Argentine government gave in to the pressure from China. Connecting this to the case of Ghana, it implies that if there are any cross-cancellation clauses agreed on under Ghana’s debt contracts with Chinese lenders, mining in the Atewa Forest is likely to go ahead no matter the pressure from the various stakeholders.

From all indications, it appears China, like every other country seeks to protect its interests first. There are variations in how different countries and institutions lend to Africa, and it is up to us make the best of what we receive. There is a pressing need to continue advocating for further transparency from governments and public scrutiny of debt contracts signed with lenders. Very often, the public is oblivious of such contracts and is usually too late by the time they have become aware to push for any significant changes.

There is typically no silver-bullet to the challenge of receiving unfavourable terms and conditions from lenders. All parties go into the negotiation room to get the best out of it; and admittedly some countries do it better than others. Sitting outside the negotiation room, it is easy to shift the blame on government – but I do not intend to make a case for our leaders either. Leadership in all its forms is a difficult job, and whoever is brave enough to come forward cannot offer excuses for unsatisfactory work.

The writer is a Development Economist in training, a poet and storyteller with pockets of experience in diverse industries and sectors; Insurance, Higher Education, Renewable Energy and Finance. Currently serves as the Postgraduate Officer at the University of Manchester Students Union where he advocates for various concerns of the student body. He also sits on the University’s Board of Governors.

Email: [email protected]

Linkedin: Nana Fredua Agyeman