By: Kwadwo Acheampong

Many of us think of the Ghana Stock Exchange (GSE) as just that: a stock exchange, a market for shares only. However, aside shares, fixed income securities like corporate bonds and Government of Ghana Treasury securities are also traded on the exchange. In fact, the volume of these securities traded on the stock exchange is significant, compared to equities.

Prior to the formation of the Ghana Fixed Income Market (GFIM), treasury instruments and a few corporate bonds traded on the stock exchange. Although at the time, volumes of transactions were small, the secondary market for treasuries afforded liquidity and encouraged trading as opposed to holding the security till maturity. However, a number of institutions were formed to improve on the operations of fixed income securities trading and enhance the domestic bond market. A first Depository was established by the Bank of Ghana in November 2004 alongside an Electronic Auction to manage the issue, custody, dealing and redemption of government securities. At the GSE, to satisfy a prerequisite for the implementation of an Automated Trading System, the GSE Securities Depository was formed. It was a wholly owned subsidiary of the Exchange and it began operation in November 2008. It was incorporated “…to facilitate the dematerialization of securities, the admittance of securities into the securities depository system and provide facilities for effective electronic deliveries of book-entry securities”. In recognition of the small size of the country’s capital markets, these two Depositories merged to form the Central Securities Depository, a one-stop shop for registering all transactions and holdings associated with all publicly traded securities. This was a meaningful and impactful step in the development of the domestic bond market.

Another institution that has helped bring investments in fixed income securities to the fore is the Ghana Fixed Income Market. It is a market for the secondary trading of fixed income securities and other securities which may be determined with time.

The Ghana Fixed Income Market

There had been a number of discussions about the setting up of a domestic bond market to facilitate the trading of bonds and other fixed income issues on an organized platform. A technical committee, comprising market operators and regulators from the GSE, was set up to:

- Establish the market

- Develop the rules for the market

- Advise and select technology infrastructure for the market

- Organize training and education of the market operators and the general investing public

After further deliberations with regulators from The Securities and Exchange Commission (SEC) and the Bank of Ghana (BoG), the Ministry of Finance and senior management officials of some banks, the Market was formed in August 2015.

Key among the objectives of the GFIM are:

- to bring about greater efficiency;

- to effect better price discovery;

- to increase liquidity;

- to bring greater transparency in the secondary trading of fixed income securities in Ghana; and

- to bring secondary trading activities in fixed income securities in Ghana to international best practice.

Since its formation, the following securities have been admitted for trading on the Market:

- Government of Ghana treasury bills, notes and bonds;

- Bank of Ghana money market instruments;

- quasi-Government of Ghana institutions’ money market instruments, notes and bonds;

- corporate notes and bonds;

- local government bonds (i.e. metropolitan, municipal and district bonds);

- supra-national bonds;

- repos; and

- other fixed income securities.

Repurchase agreements play a crucial role in the financial market. They offer a low-risk means of managing liquidity and collateral, usually by financial institutions. These institutions can manage their risk by hedging or modifying the risk profiles of their portfolios. The Guidelines for Repo Agreements in Ghana was launched to streamline repo market operations. It endorses the Global Master Repurchase Agreement as the industry standard agreement for repo transactions in the country. It is to give investors operating in Ghana confidence and clarity. The list of eligible counterparties, hitherto dominated by the central bank and commercial banks, has also been expanded to include corporate bonds listed on the GFIM.

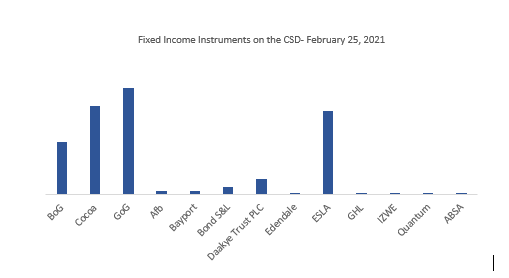

Today, bonds and other fixed income instruments trade regularly in this secondary market. Government and quasi-Government securities still form the majority (GHS 57 billion, 63%) but the number of private issues (GHS 33 billion in value, 37%) has grown significantly. Gradually, more and more non-Government institutions see the bond market and issuances on the Exchange as a viable means of raising capital.

Equities still occupy a larger portion of the value of securities registered on the CSD. This may persist for a while but fixed income securities are expected to grow in scope and value in the next few years as more institutional investors like the pension funds look for more avenues and activity in the fixed income investments space. Securities like Real Estate Investment Trusts, mortgage-backed securities and private equity issues could become available and commonplace in the capital markets soon. An expanding economy with a stable currency and an active investment climate would serve as impetus for large inflows of interest from the global investment community for local issues.