- Asset Under Management up 122%

- as benchmark outperformed with refuge sought in fixed income

Indigenous mutual fund, CM Fund, made a return of 14.97%, as its price closed the full year 2020 at GH¢1.3670 from GH¢1.1890, at the corresponding period of 2019. Consequently, the Fund outperformed its benchmark; the Weighted Average Return of Ghana Stock Exchange’s Composite Index (GSE-CI) and the 91-Day Treasury Bill by 2.19 percentage points, as the latter closed at 12.78%.

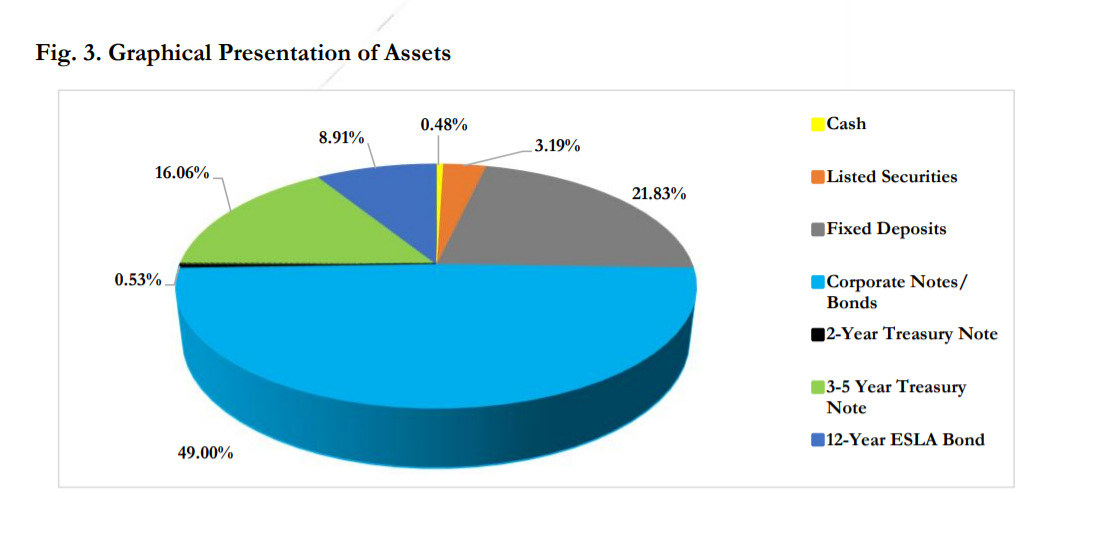

This was contained in the annual report of the CM Fund Limited, where the performance of the balanced – equity and fixed income securities – Fund was attributed to a measured diversification of the portfolio, with a bias towards fixed income on the back of “the stock market’s bearish performance.”

For context, during the fiscal year under review, the GSE-CI made a negative return of 13.98% compared to the negative 12.25% in 2019. Also, the 91-day treasury bill dropped from 14.67% to 14.09%; whilst the 182-day bill fell from 15.17% to 14.12%. Similarly, the 364-day Bill dropped from 17.83% to 16.10% as well as the three long dated Bonds; with the five, six- and seven-year bonds closing the year at 19.85, 19.50% and 20.50% respectively.

“During the period under review, the portfolio manager diversified the portfolio on the back of the stock market’s bearish performance by seeking for other high yielding fixed income investments to drive returns,” the report reads in part.

The fund also saw appreciation in value across all other major parameters. Asset under Management (AUM) was up by a significant 112.06% from GH¢8,275,585.00 in 2019 to GH¢ 17,549,083.00 in 2020. Also, the fund saw its shareholder number grow to 2,744, from 2,630 the previous year, representing a 4.33% appreciation, with units outstanding seeing an 84.65% jump from 6,886,681.26 to 12,716,090.28.

The fund also recorded a total comprehensive income of GH¢1,129,317 in 2020 as against GH¢889,940 in 2019, once again, as a result of its focus on fixed income securities.

Outlook

Managers of the Fund offered cautiously optimistic guidance. Whilst expecting to see a bullish surge on the equity side of things, they were measured in their optimism, hinting at a possible repeat of last year’s strategy.

Clarkson Duku Acheampong, Portfolio Manager said: “We look forward to a bullish stock market as it begins to show signs of recovery. However, we will maintain some bias towards fixed income investments as we are not too certain about the stock market yet so as to preserve value for our investors.

Although 2021 may be a particularly difficult year as it serves as a watershed year, where we are transitioning from the helpless COVID situation into one where the disease has been comparatively understood, we encourage shareholders to continue to investing in the CM Fund as it may serve as an intervening relief in their times of need.”