The general price level for good and services, measured by consumer price inflation, has seen its biggest fall since April this year

In April this year, food prices soar abnormally as a result of panic-buying to stock-up for a partial lockdown in some parts of the country, resulting in an astronomic jump for the inflation rate.

Figures released by the Ghana Statistical Services (GSS) show that inflation for August 2020 recorded a rate of 10.5 percent, representing a 0.9 percentage point lower than the rate recorded in July.

The main factor that drove the rate down was the food and non-alcoholic beverages basket which saw a decline of 2.3 percentage points lower than the 13.7 percent recorded in July.

Two sub-groups recorded inflation rates higher than the group’s average rate of 13.7 percent.

They are vegetables (21.3%), fish and other seafood (14.3%); and this translates to food being the predominant driver of year-on-year inflation in August, despite the overall rate in the group falling.

The non-food group, on the other hand, recorded a year-on-year inflation rate of 9.9 percent in August 2020 – 0.2 percentage point higher than the 9.7 percent recorded for July 2020.

Inflation for locally produced items still remains higher than imported products. Inflation for imported items was 4.8 percent, while that of locally produced goods was 12.6 percent.

At the regional level, the year-on-year inflation rate ranged from 4.7 percent in the Volta Region to 13.5 percent in the Greater Accra Region. Ashanti (11.2%), Western Region (11.6%) and Eastern (11.9%) all recorded inflation rates above the national average of 10.5 percent. Volta Region had the lowest year-on-year inflation rate.

Outlook

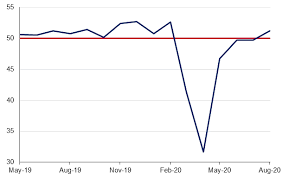

The Bank of Ghana’s Monetary Policy Committee says the sharp rise in inflation during the second quarter – as it increased to 10.6 in April from 7.8 percent in all three months at the beginning of the year – has disrupted the disinflation process with a potential of prolonging the time-horizon for reaching steady-state inflation, adding that inflation expectations of the financial sector, businesses and consumers have all trended upward.

Assessing risks to the inflation outlook, the MPC says global economic conditions, domestic economic activity, expected stability of the cedi, and government’s fiscal policy implementation amid the pandemic suggest that the balance of risks to the inflation outlook are on the upside in the forecast horizon.

It (MPC) is however confident that inflation will gradually return to the medium-term target of 8-10 percent by 2021.

“Adjusting for the unusual noise in food inflation, the indications are that underlying inflationary pressures are stable. Despite the sharp uptick in inflation during the second quarter, inflation is expected to gradually return to the medium-term target by second quarter of 2021. In the outlook, the dynamics in headline inflation are anticipated to be driven by somewhat higher expectations and the persistence of supply shocks,” the bank’s inflation outlook report said.