: The perspective of the Chartered Institute of Bankers

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) held its 98th Regular Meetings from Tuesday, January 26, 2021 to Friday, January 29, 2021 to review developments in the economy. The meetings were concluded with a press conference held on Monday, 1st February, 2021 to announce the decisions of the Committee. The Governor of the BoG, Dr. Ernest Addison disclosed that in spite of the difficult macroeconomics challenges facing the country, confidence in the country’s economy is being regained as the Bank of Ghana (BoG) reports has shown.

Dr. Ernest Addison further disclosed that results from the Bank’s latest confidence surveys conducted in December 2020 showed improvements in both consumer and business confidence. He added that consumer confidence remained firm at pre-lock down levels reflecting optimism about current economic conditions following the gradual lifting of the COVID-19 related restrictions. According to Dr. Ernest Addison, “Business Confidence improved significantly, reaching pre-lock down levels for the first time, as businesses met short-term company targets and expressed positive sentiments about growth prospects.”

The Governor of the BoG, Dr. Ernest Addison further indicated that the BoG’s updated Composite Index of Economic Activity (CIEA) recorded an annual growth of 11.9 percent in November 2020, compared to 3.4 percent growth a year ago. Dr. Addison said the key drivers of economic activity during the period were construction, port activities, imports, manufacturing and credit to the private sector.

A careful perusal of the Consumer and Business Confidence Index graph reveals a growing confidence from April to August 2020 and to the end of 2020.

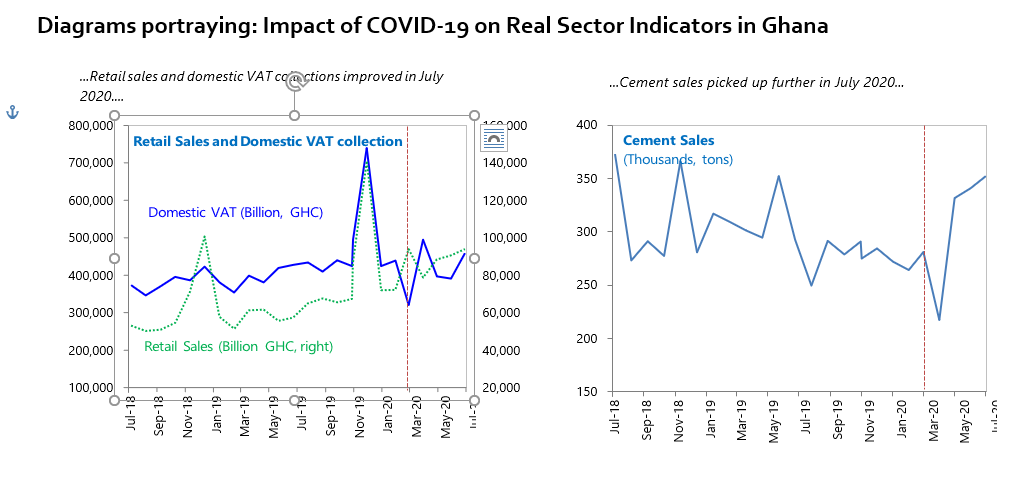

Leveraging on the gains made in the Real Sector Indicators in Ghana

Dr. Addison disclosed that two readings since the last MPC meeting indicated that headline inflation eased from 10.1 percent in October to 9.8 in November and then subsequently rose to 10.4 percent in December 2020. He said the inflation uptick in December was mainly driven by food inflation, which moved up to 14.1 percent from 11.7 percent in November. The Institute expects that annual average inflation will remain fairly stable in 2021, although there is a possibility of slight fluctuations. The exchange rate of the cedi to the major foreign currencies combined with growth in private consumption levels may be driving increases in consumer prices, notably through the rising cost of imported food items (which constitute a large share of the total food bill). We expect the BoG to manage to keep inflation within the official target band of 6-10% during 2021. However, with fiscal consolidation taking place at a relatively slow pace and domestic demand remaining robust, inflation will remain close to the upper bound of the target range.

The Economist Intelligence Unit Forecast

On the part of the Economist Intelligence Unit – a specialist publisher serving companies establishing and managing operations across national borders and has for the 60 years has been a source of information on business developments, economic and political trends, government regulations and corporate practice worldwide – in their 2019 forecast, the current account will shift from an estimated deficit of 1.8% of GDP in 2018 to a surplus of 1.1% of GDP by 2023, owing to rising oil exports over the forecast period. Unfortunately, COVID-19 led to a disruption in consumer, corporate and general business confidence, with threats to projected revenues, profitability, liquidity and corporate growth.

Key indicators

| 2018a | 2019b | 2020b | 2021b | 2022b | 2023b | |

| Real GDP growth (%) | 6.3 | 6.5 | 5.7 | 5.4 | 6.1 | 6.4 |

| Consumer price inflation (av; %) | 9.8 | 9.6 | 9.5 | 8.5 | 9.1 | 9.3 |

| Government balance (% of GDP) | -3.4 | -4.6 | -5.2 | -4.6 | -3.8 | -3.1 |

| Current-account balance (% of GDP) | -1.8c | -1.8 | -2.0 | -1.5 | 0.3 | 1.1 |

| Money market rate (av; %) | 17.0 | 16.5 | 16.0 | 15.5 | 16.5 | 17.5 |

| Exchange rate GH0:US$ (av) | 4.58 | 5.31 | 5.86 | 6.18 | 6.35 | 6.50 |

| a Actual. b Economist Intelligence Unit forecasts. c Economist Intelligence Unit estimates. |

Source: The Economic Intelligence Unit, 2019

Thankfully, the Governor of BoG, Dr. Ernest Addison has revealed the resurgence of a positive consumer and business confidence. This indeed calls for the banks in Ghana to have a new plan that leverages on the gains and the new consumer and business confidence in the economy. Banks will need to increases their speed of digitalization through the automation of many more of their activities, and will need to create operational, financial and human management resilience that builds a crisis-ready organization.

The Chartered Institute of Bankers, Ghana is of the view that as confidence in the economy and the banking sector is being regained as evinced in BoG’s statement, there is now enough grounds to have economic hope for the future, but to achieve that the banks must rise up to become more innovative. This can be best done when the banks embrace the gains being made in the macroeconomics issues in this COVID-19 era an innovative tool for development. The Institute is of the view that the banks must quickly reposition themselves to leverage on the following macroeconomic, social and political gains:

Political stability

The banks in Ghana must leverage on Ghana’s underlying political stability. This is expected to endure over the foreseeable future, despite an acrimonious multiparty-political landscape which has led the two (2) dominant political parties to the Supreme Court contesting the 2020 election results. The two dominant parties—the ruling New Patriotic Party (NPP) and the National Democratic Congress (NDC)—have alternated power since the return of multiparty politics in 1992, and their rivalry will remain the key feature of the political scene. Instances of intimidation and violence between their supporters have been reported in the past but in the 2020 election very few incidents were recorded. These are likely to continue, although such incidents are very limited outside election campaigns, and are not expected to lead to broader unrest.

Fiscal policy

The Institute expects the government to pursue an expansionary fiscal policy in their 2nd Term. This is expected to boost economic growth (and as spending is not restricted by the need to adhere to an IMF programme), before financing constraints necessitate a shift to a contractionary policy. The government has sought to strengthen the Ghana Revenue Authority, ensure broader enforcement of tax identification number measures, and build the capacity of local governments to collect taxes. From 2021 and beyond, we expect to see a recovery in oil prices, combined with increased output volumes and modest growth in the non-oil economy, causing government revenue to rise in 2021. In this 2nd Term of the NPP government, we expect to see some fiscal consolidation, particularly in the wage bill, with expenditure declining slightly as the government seeks to limit the fiscal deficit. It must be emphasized that, longer-term debt sustainability will still require ongoing fiscal responsibility and continued robust levels of economic growth.

Economic growth

Considering the new struggle for lives and livelihood, the Institute believes that economic growth over the period will be driven predominantly by the services, agriculture and hydrocarbons sectors, with a continued ramping up of oil and gas production expected. It must however be stated that, this oil-driven growth may mask constraints such as low productivity, infrastructure bottlenecks and relatively weak access to credit elsewhere in the economy. We expect there to be some spillover effects from hydrocarbons with increases in broader industrial production, infrastructure investment and auxiliary services but this will be fairly limited. The banks must consider investing in these sectors.

External sector

The Institute believes that the increasing oil output, combined with rising production and prices of gold, will help to boost export earnings in 2021, although some moderation will come from declining prices and reduced output for cocoa. We expect steady growth in export revenue in 2021. Oil production from new fields will increase strongly—both in the near term and in the latter part of 2021 and government efforts to formalize small-scale mining and to provide large mines with better protection from illegal incursion will support gold production. Rising import expenditure will be driven by steady growth in the domestic economy and strong demand for capital goods imports to support ongoing infrastructure development.

The Chartered Institute of Bankers, Ghana Perspective

To consolidate the gains and confidence of consumers and businesses in the banking sector, the Institute will want to reaffirm that banking thrives on the confidence, poise and self-assurance that stakeholders, customers, and clients have in bankers. Apart from the knowledge, skills and technical expertise professionals in the industry possess there is the need to exhibit integrity in order to gain the confidence of the public. Customers expect the banks and banking practitioners to stand for something more than just profits. They expect us to keep to our brand promise either as individuals, practitioners or as financial institutions.

The Institute also commends the Receivers and Liquidators of the defunct financial Institutions on the seamless manner they administered the locked-up funds as a result of the banking sector clean-up exercise. Despite the initial challenges and complaints by depositors, the Receivers have been able to help restore confidence in the industry by paying the majority of depositors. The complaint management process instituted in the course of the exercise is also worthy of commendation. The Institute prays that outstanding funds that are going through the legal system will be settled and paid as soon as practicable. To enhance the customer complaint management process, the Institute will recommend that the Banks should consider investing some of their time and resources to education their customers and the general public to channel their complaints through the banks rather than resorting to social media.

The Institute has observed that the problem of unethical infractions in the banking sector arises due to lack of understanding of the ethical issues at stake, or an inability to make a distinction between what is ethical, legal or both. With the support of the Bank of Ghana and Ghana Association of Bankers, the Institute has developed the Ghana Banking Code of Ethics and Business Conduct which was launched by the Governor in 2020. The Code seeks to regulate the behaviors of practitioners in the banking industry and contains principles to guide acceptable banking work ethics and positive social lifestyles. It is the belief of the Institute that the introduction of the Ghana Banking Code of Ethics and Business Conduct which addresses the human factor in the recent banking crises has come to complement the supervisory reforms and regulatory directives by Bank of Ghana to fully restore confidence in our industry.

Banks worldwide have been undergoing rapid transformation in their business models through innovations in technology and shifts in customer expectations but recent insurgence of mobile telephony and digitalization have had the most impact on the banking business in Ghana. The Institute believes that investment in human capital development must run along with technology to create agile businesses and sustain profitability. A work force well-resourced with digital skills that is capable of mastering and navigating technology in the business of banking is required. That is, bank staff must be fit for purpose. Staff knowledge and the application of mega trends in technology have become a core skill that bankers need to remain fit for purpose in the industry. Ideal technology and mega trend awareness and skills would be required by practitioners to either correspond to the industry-wide technology adoption or surpass it. Some tech-trends fizzle out and die a quiet death, while others are so significant that they transform our world and how we live in it.

The Institute will rather want to quickly mention that, as organizations deploy more sophisticated technologies as a catalyst for improved performance, criminals and criminal organizations by their prying eyes also sense an opportunity. Digital transformation has also created new vulnerabilities that criminal groups are quick to exploit and monetize. So we recommend that our individual banks must consider investing a bit more into cybersecurity – for the protection of computer systems and networks from the theft of or damage to their hardware, software, or electronic data, as well as from the disruption or misdirection of the services they provide – including their valuable intellectual, customer data and financial assets.

To equip practitioners to keep and raise the confidence of customers, the Chartered Institute of Bankers, Ghana is aligning its Professional Education to these new mega trends and have embarked on a major curriculum review of the Associate Banker Program. We are happy to report that the process is progressing and we are confident that the new curriculum will be implemented in 2022. The new Curriculum Review will also introduce new Certification programs that seeks to certify Experts who undergo training to build the required skills set in the delivery of banking services and other areas of prudential concerns in the industry. Additionally, to bridge the knowledge gap of practitioners, the Institute will use its Continuing Professional Development Programs to help practitioners upskill and where required reskill to secure their job roles.

Conclusion

Banks must be more innovative in these economic turbulent times to drive their markets. Innovation is the new way that will keep the ‘marriage’ between the banks and the consumers and business community. Our banks must therefore be more innovative to stay on top of the minds of the market actors. The banks must consider “carrying out of new combinations” that include “the introduction of new products, new services, and the creation of new markets. ISO TC 279 on innovation management proposes in the standards, ISO 56000:2020 to define innovation as “a new or changed entity creating or redistributing value” and for the purposes of the banks creating a focus on “newness, improvement and spread”. Innovation is also often viewed as taking place through the provision of more-effective and enhanced processes, technologies, or business models that innovators make available to markets, economies and societies. Bank innovation must be original and more effective and, as a consequence, new, that “breaks into” the consumer market and or business society.

Innovation is generally considered to be the result of a process that brings together various novel ideas in such a way that they affect society. In many advanced economies, innovations are created and found empirically from services to meet growing consumer growing and changing demands and there is always a distinction between sustaining and disruptive innovations. Sustaining innovation is the improvement of a product or service based on the known needs of current customers whereas disruptive innovation in contrast refers to a process by which a new product or service creates a new market, eventually displacing established competitors. Banks must therefore strike to improve on their innovations to attract, retain and grow consumers and business into the banking space and for that matter their raise confidence the more in the Ghanaian economy.