…as maiden Banking Consumer Satisfaction Index report launched

The Chartered Institute of Marketing Ghana (CIMG) has carried out the country’s maiden Consumer Satisfaction Index (CSI) report, focusing on the banking sector for the pilot study.

The index seeks to measure service quality, customer satisfaction and customer loyalty, as well as establish a standard customer satisfaction index for the banking industry, and scored the banking sector’s overall performance at 95 percent.

The score is based on average performance of the top-five banks. However, only two banks out of the 22 surveyed crossed this ‘average’ mark. In terms of overall service quality, only 11-banks were rated five-star, 10-banks rated four-star and one bank fell lower to two-star bank status.

Based on this survey’s parameters, the star rating of individual banks are as follows: (91-100 percent) five-star; (81-90) four-star; (71-80) three-star; (51-70) two-star; and (0-50) one-star or poor service.

The CSI report findings show that in terms of behavioural and emotional loyalty, which is one of the models of measurement, none of the banks recorded five-star ratings, with the overall customer loyalty score being 73 percent – a situation the researchers described as worrying, and hence called on the banks to pay attention as strong customer loyalty consequentially translates into positive market shares, increased income and profit.

According to the researchers, with service quality as the main tool used for establishing the CIMG-CSI, the accepted cut-off point was performance greater than 70 percent. Anything short of that could easily lead to customers taking actions of different kinds, including legal actions.

The survey sampled about 2,300 customers of traditional banks in Accra, Kumasi, Takoradi and Tamale – using specific metrics such as responsiveness, reliability, tangibles, assurance and empathy.

It was noted that while customers were much interested in the responsiveness and reliability of their banks, the banks were mostly focused on providing tangibles and assurance.

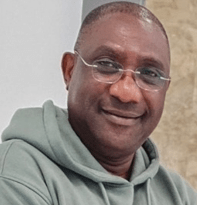

In his address at the CSI-Banking report launch, National President of CIMG, Dr. Kasser-Tee, stated that the CIMG-CSI Banking Report serves as an important complement to traditional measures of economic performance; providing useful information for banks, their shareholders, investors, government, regulators and, most importantly, consumers.

He urged all the 23 universal banks to subscribe to this report, which will be produced annually as the findings will be very useful in shaping their decisions and actions on the three important study variables of service quality, customer satisfaction and customer loyalty, taking note of their individual and combined effects on bank performance.

“Understanding the behavioural intentions of customers has financial consequences, as they affect income statements immediately, and subsequently balance sheets. Each bank will also see how they performed against their peers and industry averages.

“We are excited about the fact that Ghana is today leading countries in the sub-region, joining the likes of South Africa to establish this index on the continent. I assure you that the CIMG-CSI will help product and services organisations in Ghana to improve service quality standards,” he said.

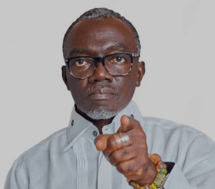

Representing the Bank of Ghana (BoG) Governor, Head-Financial Stability, Dr. Joseph France, indicated that the regulator is excited about the banking CSI report, as it seeks to improve customer service delivery in the banking sector.

He reiterated that BoG will continue ensuring that the interests of consumers in the banking sector are protected.

“This report will be a tool/reference document for the BoG to use in its regulatory work to better address customers’ challenges with their banks, as well as a tool for banks, on the other hand, to use in improving their services and products to clients,” he said.