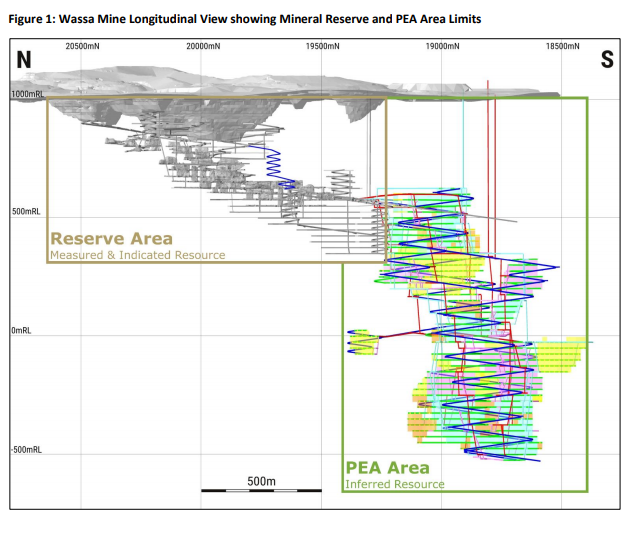

Golden Star Resources Limited has filed a technical report that includes a preliminary economic assessment to expand its Wassa underground gold mine in Ghana. According to the company, its preliminary economic assessment provides enough evidence to develop the mine and to fully utilise the available process plant capacity.

The company said in a statement that the preliminary economic assessment represents a conservative plan, which excludes exploration opportunities from the scope and adopts the current mining practices and equipment to deliver a robust economic outcome while minimising execution risk.

It assured that “opportunities to improve productivity and reduce the environmental impact of the operation through the application of technology will be evaluated in the next phase of work”.

Providing some updates on its operations in 2020, the company said it achieved an 86% increase in measured mineral resource and 98% increase in proven mineral reserve at the Wassa underground mine. “This demonstrates the improving geological confidence that has been delivered by recent infill drilling programmes,” the statement copied to the Ghana Stock Exchange said.

On his part, the Chief Executive Officer of Golden Star, Andrew Wray, said in 2020 the company focused on improving its geological confidence in the orebody through an extensive infill drilling programme, which resulted in a significant increase of measured resource and proven reserve.

“Converting the open-pit reserve at Wassa to an underground reserve allowed us to bring production from those areas forward with a lower upfront capital cost,” he said, assuring development of the Upper Mine will start to deliver production from 2023, and will provide a second decline access to the mine that can be incorporated into the long-term mine design.

Mr. Wray disclosed that the preliminary economic assessment demonstrates a significant value and growth potential of Wassa, laying out the path to underground mining rates in excess of 7,000tpd and production of approximately 300koz per annum when in steady state production.

“Following this study and with a stronger balance sheet, we are in a position to further accelerate the investment in drilling, development and exploration programmes to deliver on the growth potential and value of Wassa.”

He explained that with moderate conversion factors and cost estimates based on actual performance, the Preliminary Economic Assessment demonstrates the potential for an after-tax NPV of US$783m at the long-term consensus gold price of US$1,585/oz.